Simply Solar Illinois Can Be Fun For Everyone

Simply Solar Illinois Can Be Fun For Everyone

Blog Article

Getting My Simply Solar Illinois To Work

Table of ContentsSimply Solar Illinois Things To Know Before You BuyThe Best Strategy To Use For Simply Solar IllinoisSome Known Facts About Simply Solar Illinois.Simply Solar Illinois Fundamentals ExplainedNot known Incorrect Statements About Simply Solar Illinois

Our team partners with local communities throughout the Northeast and past to provide clean, economical and trusted power to foster healthy neighborhoods and maintain the lights on. A solar or storage project provides a number of benefits to the community it offers. As technology advancements and the expense of solar and storage decline, the economic benefits of going solar continue to climb.Assistance for pollinator-friendly environment Habitat restoration on contaminated websites like brownfields and land fills Much required color for animals like lamb and chicken "Land banking" for future farming use and dirt top quality improvements Due to environment adjustment, extreme weather condition is ending up being much more constant and turbulent. Because of this, house owners, services, neighborhoods, and utilities are all becoming increasingly more thinking about securing power supply solutions that provide resiliency and energy protection.

In 2016, the wind energy market straight used over 100,000 full-time-equivalent employees in a selection of capacities, including production, task development, building and wind turbine setup, procedures and maintenance, transportation and logistics, and monetary, legal, and speaking with solutions [10] Greater than 500 manufacturing facilities in the United States manufacture components for wind generators, and wind power job installments in 2016 alone represented $13.0 billion in investments [11] Environmental sustainability is another crucial vehicle driver for businesses purchasing solar energy. Several firms have durable sustainability objectives that consist of lowering greenhouse gas exhausts and making use of much less resources to help decrease their influence on the natural surroundings. There is a growing necessity to deal with climate change and the stress from customers, is getting to the leading degrees of companies.

Simply Solar Illinois Things To Know Before You Get This

As we approach 2025, the combination of photovoltaic panels in industrial projects is no more just an option however a tactical requirement. This blogpost delves right into just how solar power jobs and the diverse advantages it brings to business structures. Photovoltaic panel have actually been made use of on household buildings for years, yet it's just just recently that they're becoming a lot more common in business construction.

In this post we review exactly how solar panels job and the advantages of making use of solar power in business structures. Electricity costs in advice the United state are enhancing, making it a lot more costly for services to run and much more difficult to prepare ahead.

The U - Simply Solar Illinois.S. Power Details Administration expects electric generation from solar to be the leading source of growth in the U.S. power industry with the end of 2025, with 79 GW of new solar capacity projected to come online over the following 2 years. In the EIA's Short-Term Power Overview, the company said it expects renewable resource's general share of electrical power generation to rise to 26% by the end of 2025

Not known Details About Simply Solar Illinois

The photovoltaic solar cell soaks up solar radiation. The cables feed this DC electricity into the solar inverter and transform it to alternating power (A/C).

There are several methods to keep solar energy: When solar power is fed into an electrochemical battery, the chain reaction on the battery components maintains the solar power. In a reverse reaction, the existing departures from the battery storage space for consumption. Thermal storage utilizes tools such as molten salt or water to keep and take in the heat from the sun.

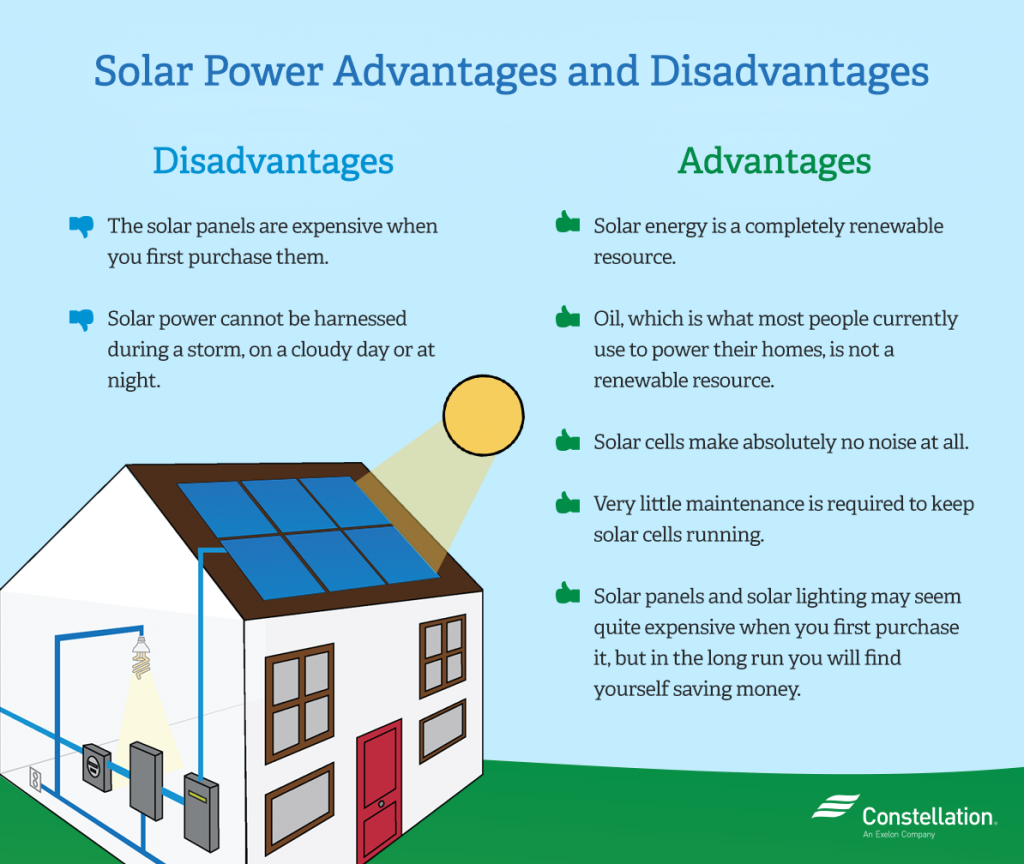

Solar panels significantly lower energy expenses. While the first investment can be high, overtime the cost of mounting solar panels is recouped by the money conserved on electricity costs.

The smart Trick of Simply Solar Illinois That Nobody is Talking About

By setting up solar panels, a brand name shows that it respects the setting and is making an initiative to decrease its carbon impact. Buildings that rely totally on electric grids are useful content at risk Visit Your URL to power interruptions that happen during negative weather or electric system breakdowns. Solar panels mounted with battery systems enable industrial buildings to remain to work throughout power failures.

Little Known Questions About Simply Solar Illinois.

Solar energy is one of the cleanest kinds of power. In 2024, property owners can profit from federal solar tax rewards, allowing them to offset almost one-third of the purchase rate of a solar system via a 30% tax obligation credit report.

Report this page